7 Medicare Questions You Should Know How to Answer if You’re Over 60

Medicare covers millions of Americans, yet is still widely misunderstood. Knowing when to enroll in Medicare, what Medicare covers, and the costs associated are just a few crucial things to know as you approach Medicare eligibility.

Despite Medicare insuring millions of Americans each year, it is still widely misunderstood. Medicare beneficiaries are commonly unaware of when to enroll, if they need to sign up, and what Medicare covers (and does not cover).

Important Medicare Questions

We have boiled the complexities of Medicare down to seven crucial questions that you need to know the answers to regarding your Medicare coverage.

1. What is Medicare?

As defined by Medicare.gov, Medicare is federal health insurance for people 65 or older, some younger people with disabilities, and people with End-Stage Renal disease.

It’s also important to know that Medicare is NOT Medicaid. Medicaid is a completely different government insurance program that provides health coverage to low-income adults, children, pregnant women, elderly adults, and certain people with disabilities.

Medicare is comprised of four main parts, including:

- Part A (Hospital Insurance)

- Part B (Medical Insurance)

- Part C (Medicare Advantage)

- Part D (Prescription Drug Coverage)

2. What is the difference between Original Medicare vs. Medicare Advantage?

There are two choices for receiving Medicare coverage: Original Medicare and Medicare Advantage. Qualifying beneficiaries must choose one of the two.

Original Medicare is made up of Part A, Part B, and potentially Part D (Prescription Drug Coverage). Medicare Advantage, known as Part C, combines Parts A and B (and usually D) into one plan.

There are a few key differences when evaluating Original Medicare vs. Medicare Advantage. The first differentiator is where you can receive care. Under Original Medicare, you can go to any doctor, healthcare provider, hospital, or facility that is enrolled in Medicare and accepting new Medicare patients. You do not need a referral, but the specialist you see must be enrolled in Medicare.

Under Medicare Advantage, you’ll likely be bound to certain “in-network” healthcare providers, as your plan may not cover services from providers outside the plan’s network. You may also need to get a referral to see a specialist under Medicare Advantage.

Cost is another big differentiator. Original Medicare is designed to be more like an 80/20 plan, where you would be responsible for approximately 20% of your total healthcare costs (specific additional costs for Part A and Part B are discussed more below). Medicare Advantage, however, often requires less out-of-pocket costs, although these out-of-pocket costs vary from plan to plan.

To avoid having to pay 20% of total healthcare costs under Original Medicare, many people will get additional insurance, known as a Medicare Supplement or Medigap policy. Medigap policies are not available (and not particularly necessary) if you are covered under Medicare Advantage.

Lastly, as mentioned earlier, prescription drug coverage is often included through Medicare Advantage plans, but not with Original Medicare. Under Original Medicare, a separate Part D prescription policy would be required for your prescription costs to be covered.

The focus of this article will primarily be around the issues, coverage, and costs of Original Medicare.

3. What does Medicare cost?

Cost of Medicare Part A

Part A of Medicare is usually free, as long as you or your spouse paid Medicare taxes for a certain amount of time. However, if you do not qualify for premium-free Part A, it is also available for purchase. The monthly premium for Part A (if you don’t qualify for premium-free Part A) is either $259 or $471 per month, depending on how long you or your spouse worked and paid Medicare taxes.

If you choose to not buy part A, you can still buy part B. However, in most cases, if you choose to buy part A, you must also have Part B and pay monthly premiums for both.

There are a few easy ways to find out if you qualify for premium-free Part A. You can get Part A for free if:

- You’re already receiving benefits from Social Security or the Railroad Retirement Board

- You’re eligible for Social Security or Railroad benefits but haven’t filed for them yet

- You or your spouse had Medicare-covered government employment

- You are under 65 and have received Social Security disability or Railroad Retirement Board disability benefits for 24 months

- You have End-Stage Renal Disease (ESRD) and meet certain requirements

Cost of Medicare Part B

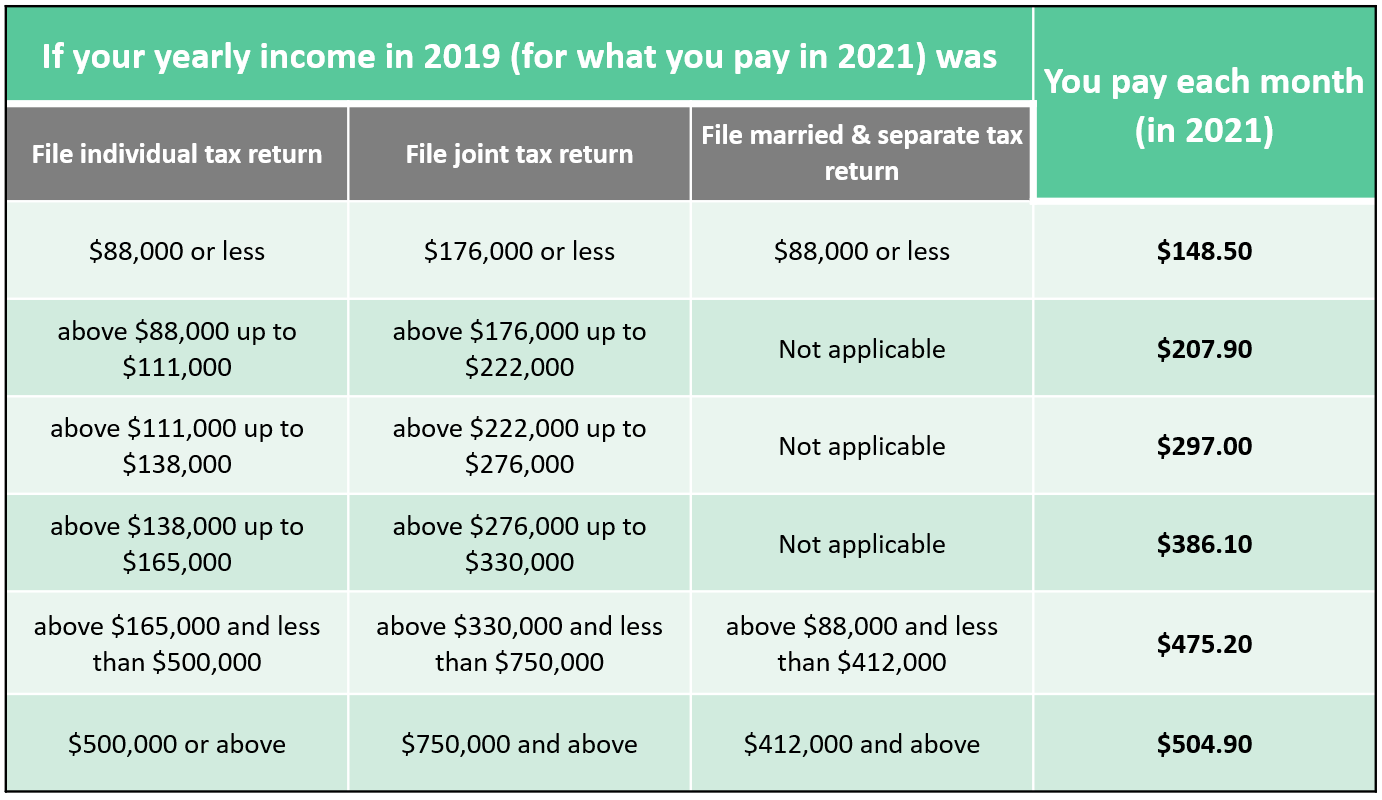

Unlike Part A, Medicare Part B requires a monthly premium that is based on income. In 2021, the base premium amount is $148.50 per month. However, if you earn over certain income thresholds, you may have to pay an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

The table below outlines the income thresholds and IRMAA surcharges that could apply to higher-income individuals and couples.

The IRMAA thresholds are cliff-style limits where falling just $1 over the limit could trigger a Part B premium surcharge. For retirees that can do so, avoiding these premium surcharges could be an impactful part of your retirement income plan.

4. What Does Medicare Cover?

What Does Medicare Part A Cover?

Part A is known as “Hospital Insurance.” It covers a range of services associated with a hospital stay, including:

- Inpatient care in a hospital

- Skilled nursing facility care

- Nursing home care (Medicare does not cover custodial care, which is help with activities of daily living)

- Hospice care

- Home health care

To determine if you may eligible to receive Part A coverage on the services listed above, be sure to visit Medicare.gov to learn more, as there may be circumstances where Medicare may not cover services or treatment you receive at the facilities listed above.

In addition to the Part A premium, you could also be required to pay additional costs for services covered by Part A. For example, for inpatient care in a hospital, there is $1,484 deductible (in 2021) that you would be responsible for per each benefit period (if you do not have a Medigap policy). A benefit period begins the day you are admitted as an inpatient in a hospital or skilled nursing facility and ends when you have not received any inpatient hospital care for 60 days in a row. Again, this deductible is paid per benefit period, not annually, so you could be required to pay the inpatient deductible more than once in a year.

Also, for days 61-90 of inpatient care, you are responsible for $371 coinsurance per day. For days 91 and beyond, the coinsurance increases to $742 per each “lifetime reserve day” (all amounts are for 2021). You are allowed 60 lifetime reserve days that can only be used once.

Potential costs for a stay in a skilled nursing facility are slightly different. From days 21-100, there is a $185.50 coinsurance per day. After 100 days, you are responsible for all costs. See Medicare.gov for more information on what your potential out-of-pocket costs are for hospice and home care. You can also consult with your healthcare provider to see what portion of their services may be covered by Medicare.

Lastly, keep in mind that a Medicare Supplement or Medigap policy could help cover these potential out-of-pocket costs. You should evaluate your options for Medigap to protect against paying hefty additional hospital fees.

What Does Medicare Part B Cover?

Part B covers services that are deemed medically or preventative. Medicare.gov cites examples of these types of services, including clinical research, ambulance services, other services/supplies needed to treat your condition, and an array of screenings and tests.

Medicare Part B requires an annual deductible of $203 (in 2021) and then, in most cases, you would be responsible for 20% of the Medicare approved amount beyond the deductible. Again, a Medicare Supplement or Medigap policy can help cover a portion of your Part B out-of-pocket costs. For more on Medigap plans, click here.

What Isn’t Covered?

Just as it’s important to know what Medicare covers, you should also know what it does not cover. Medicare does not cover the following services:

- Long-term care

- Most dental care

- Eye exams

- Dentures

- Cosmetic surgery

- Acupuncture

- Hearing aids and exams

- Routine foot care

To find out if a specific service or treatment is covered, click this link to search on Medicare.gov. You can also ask your healthcare provider if Medicare covers their services.

5. Should I get Medicare Parts A and B?

One confusing part of Medicare is knowing if you should actually sign up for Part A and Part B, perhaps because you have coverage through your spouse or current employer. There are several scenarios that may cause someone to think they don’t need to sign up, many of which are outlined at Medicare.gov. Surprisingly, the answer to whether you should get Part A and Part B often depends on the number of employees your employer has.

Yes, that’s right. It’s the number of employees that determines if you should get Parts A and B when you become eligible, and the magic number seems to be 20 employees. Employees of companies with less than 20 employees fall under different rules than those with over 20 employees. According to Medicare.gov, if your employer has less than 20 employees, you should sign up for both Part A and Part B when you first become eligible.

For example, what if you are still working at age 65 and have coverage through work? Should you get Parts A and B?

Well, if your employer has less than 20 employees, Medicare.gov says you should get both Part A and Part B when you are first eligible. If you don’t, you may have to pay steep penalties down the road.

The Part A late enrollment penalty is an extra 10% of your Part A premium for twice the number of years that you could have paid premiums for Part A but didn’t. Keep in mind, if you are eligible for premium-free Part A, you can enroll at any time after you become eligible and avoid a late enrollment penalty.

However, Part B is different. If you fail to enroll in Part B when first eligible, you may have to pay a late penalty up to 10% higher for each 12-month period you could have had Part B but did not sign up. Even worse, this penalty lasts for life!

On the flip side, if your employer has group health plan coverage for 20 or more employees (as defined by the IRS), you may be able to delay enrollment in Part A and Part B and will not have to pay a lifetime late enrollment penalty if you enroll later (rules apply once employment ends).

Similar rules apply if you have retiree coverage through your former employer, retiree coverage through your spouse’s former employer, or coverage through your spouse who is currently working. Go to the “Should I Get Parts A & B” page on Medicare.gov to read more about these and other scenarios.

6. Do I need to sign up for Medicare? If so, when?

Because some individuals get Medicare automatically, others think they do not need to sign up. The fact is that some need to sign up and some do not. Determining if you need to sign up depends on if you are receiving Social Security or Railroad Retirement Board benefits at the time you turn 65 (in most cases).

For example, in most cases, you do not need to sign up if you have received Social Security or Railroad Retirement Board benefits at least 4 months prior to turning 65. Otherwise, you probably need to sign up.

As a side note, if your birthday is the first of the month, coverage will start the first of the prior month.

Read about other scenarios that may apply to you at Medicare.gov.

When do I sign up for Medicare?

When you’re first eligible for Medicare, you have a 7-month Initial Enrollment Period to sign up for Part A and/or Part B that:

- Begins 3 months before the month you turn 65

- Includes the month you turn 65

- Ends 3 months after the month you turn 65

7. How do I sign up for Medicare?

To sign up, you can apply online on the Social Security website. Click here for more information on how to get started.

You can also visit your local Social Security office or call Social Security at 1-800-772-1213. If you worked for a railroad, call the RRB at 1-877-772-5772. If you already have Part A and want to sign up for Part B, complete an Application for Enrollment in Part B (CMS-40B).

There is an Open Enrollment period in which you can sign up for Medicare, unless you qualify for an Initial Enrollment Period or Special Enrollment Period. The Open Enrollment Period is from October 15th – December 7th each year.

To learn more about enrollment periods, read more at Medicare.gov.

Bottom Line

Medicare is an important part of everyone’s retirement plan. As you approach your initial eligibility, be sure to consult with a qualified advisor to ensure you sign up on time, avoid late enrollment penalties, avoid coverage gaps, and choose your best coverage option. For a personalized Medicare quote and analysis, contact us at 618-288-9505 or schedule a call below.

Joe Allaria, CFP®

Wealth Advisor | Partner

Free Retirement Assessment

Our free assessment will show you how to invest confidently, reduce taxes, and retire successfully. We want you to know exactly how we can help before you pay us a single dollar.