Q&A: How will the Tax Cuts and Jobs Act of 2017 impact me?

December 22nd, 2017 marked the date of our nation’s biggest tax overhaul since 1986 as President Trump signed into law the much anticipated Tax Cuts and Jobs Act of 2017. But, many Americans are questioning what the new tax bill will do for them, and it’s likely the impact will be significant for both corporations and individuals.

December 22nd, 2017 marked the date of our nation’s biggest tax overhaul since 1986 as President Trump signed into law the much anticipated Tax Cuts and Jobs Act of 2017. But, many Americans are questioning what the new tax bill will do for them, and it’s likely the impact will be significant for both corporations and individuals.

However, while the intent of the bill was to lower tax liability for the majority of Americans, it is still imperative that you speak with a qualified tax specialist to discuss your specific situation. Below, we list our top 10 highlights that you’ll need to be aware of as you determine what will change for you.

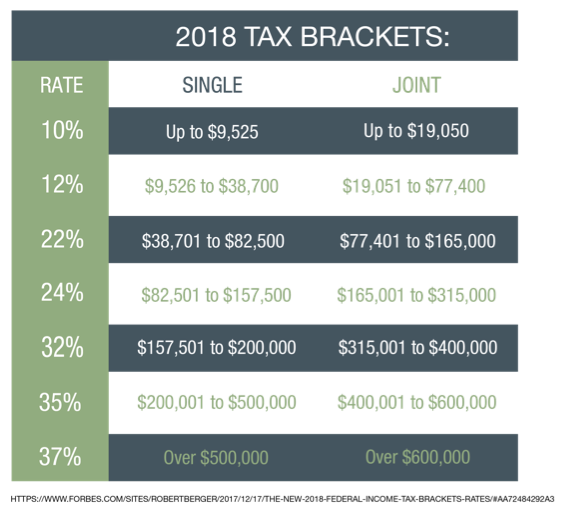

1. New Ordinary Income Tax Brackets:

While there are still 7 different income tax brackets, the rates and thresholds have been changed. See the newly structured brackets pictured here.

2. Higher Standard Deduction, but Exemptions Eliminated

The standard deduction will be increasing in 2018 to $12,000 for individuals (previously $6,350) and $24,000 for married couples filing jointly (previously $12,700). However, this is in combination with the elimination of personal exemptions, which was set to $4,050 per person for 2017.

3. Changes to Itemized Deductions

Starting in 2018, there will be new restrictions on itemizing that could reduce its effectiveness as a tax-savings strategy. Some of those changes include:

- SALT/Property tax deduction cap: Married taxpayers filing jointly and single taxpayers may deduct up to $10,000 in combined: 1) state and local property taxes and 2) either (i) state and local income taxes or (ii) state and local sales taxes. (i.e. If you pay a combined $20,000 in State, Local, and real estate tax, you would only be able to deduct $10,000 of that $20,000 if you chose to itemize)

- Mortgage interest restriction: Married taxpayers filing jointly and single taxpayers may deduct interest paid on up to $750,000 of mortgage indebtedness. This new limitation will only apply to mortgage indebtedness incurred after December 15, 2017. Taxpayers will no longer be allowed to deduct interest paid on home equity indebtedness (regardless of when the indebtedness was incurred).

- Medical Expense Deduction Threshold: In 2017 and 2018, taxpayers who have reached age 65 before the close of the taxable year may deduct unreimbursed medical expenses to the extent such expenses exceed 7.5% of the taxpayer’s AGI. This 7.5% threshold will apply to married taxpayers if either spouse has reached age 65 before the close of the taxable year. On January 1, 2019, the AGI threshold will revert back to 10%.

- Misc. Itemized Deductions: Taxpayers will no longer be able to utilize miscellaneous itemized deductions that exceed 2% of the taxpayer’s AGI. Among the miscellaneous itemized deductions that will be eliminated are tax preparation expenses, unreimbursed employee business expenses, and investment advisory fees.

- Phaseout for Using Itemized Deductions: Previously, itemized deductions were phased out at certain income thresholds. This phaseout will be eliminated.

- Deduction for Alimony: Taxpayers who are obligated to pay alimony to an ex-spouse through a divorce or separation instrument executed after December 31, 2018, will no longer be able to deduct those payments from their AGI. Likewise, alimony payments received by a taxpayer will no longer be treated as taxable income. This rule will also apply to alimony payments arising from a divorce or separation instrument executed on or before December 31, 2018, and modified after that date if the modification expressly provides that this new law applies to the modification.

4. Enhanced Child Tax Credit

The child tax credit will be increased to $2,000 for each qualifying child under age 17. The amount of this credit is not indexed for inflation. Taxpayers will also receive a $500 nonrefundable credit for each dependent who is not a qualifying child. AGI phaseouts for these credits will begin at $400,000 for married taxpayers filing jointly and $200,000 for all other taxpayers.

5. Use of 529 Plans

Taxpayers will now be able to make tax-free distributions from 529 Plans for elementary and secondary school expenses. Such distributions may not exceed $10,000 per student annually.

6. Impact of AMT (Alternative Minimum Tax)

The AMT exemption amount will increase to $109,400 for married taxpayers filing jointly and $70,300 for single taxpayers. The exemption phaseout thresholds will increase to $1,000,000 for married taxpayers filing jointly and $500,000 for single taxpayers. These exemption amounts and phaseout thresholds will be indexed annually for inflation.

7. Estate, Gift, and Generation-Skipping Transfer Tax Exemptions doubled

The individual unified estate and gift tax exemption and the generation-skipping transfer tax exemption will double to $11,200,000 per individual. This figure will continue to be indexed annually for inflation.

8. New Deduction for Pass-Through Income

Married taxpayers filing jointly with taxable income below $315,000 and individuals with taxable income below $157,000 will be allowed to deduct 20% of qualified business income generated by a pass-through entity (including those businesses organized as sole proprietorships, partnerships, limited liability companies, and S corporations). Taxpayers eligible for this deduction may use it in addition to the standard deduction. Investment income from a pass-through entity, “reasonable compensation” to an S corporation owner-employee, and guaranteed payments for services rendered in a partnership or LLC will not be eligible for the qualified business income deduction. * **

*Taxpayers with pass-through income generated by specified service businesses will be completely phased out of this deduction over the first $50,000 of taxable income ($100,000 for married taxpayers filing jointly) exceeding the thresholds noted above. Specified service businesses include health, law, accounting, actuarial sciences, performing arts, consulting, athletics, and financial services.

**Taxpayers with pass-through income generated by all other businesses who have taxable income exceeding the thresholds noted above will have their deduction limited to the lesser of: 1) 20% of business income or 2) the greater of (i) 50% of total W-2 wages paid to employees or (ii) 25% of W-2 wages paid to employees plus 2.5% of the unadjusted basis of depreciable property.

9. Affordable Care Act Mandate repealed

The individual Affordable Care Act mandate will be repealed as of January 1, 2019. Other Affordable Care Act tax hikes, including the 3.8% net investment income tax and 0.9% Medicare surtax, will remain unchanged.

10. Recharacterizing Roth Conversions

Previously, taxpayers who elected to convert a traditional IRA to a Roth IRA had the option to recharacterize the account as a traditional IRA prior to their tax return being filed. This will no longer be allowed after December 31, 2017.

CarsonAllaria Wealth Management does not give tax advice. Please seek tax advice from a qualified tax specialist.

All articles and posts are provided by CarsonAllaria Wealth Management (CAWM or firm) for informational purposes only. By accessing or otherwise using this Article, you agree to be bound by the terms and conditions set forth below. Investing involves the risk of loss and investors should be prepared to bear potential losses. Past performance may not be indicative of future results and may have been impacted by events and economic conditions that will not prevail in the future. Therefore, it should not be assumed that future performance of any specific security, investment product or investment strategy referenced in the Article, either directly or indirectly, will be profitable or equal to the corresponding indicated performance level(s). No portion of the Article shall be construed as a solicitation to buy or sell any specific security or investment product or to engage in any particular investment strategy. In addition, this Article shall not constitute the provision of personalized investment, tax or legal advice, and investors shall not assume this Article serves as a substitute for personalized individual advice. Information contained in this Article may have been derived from third-party sources that CAWM believes to be reliable; however CAWM does not control such information and does not guarantee the accuracy or timeliness of such information and disclaims all liability for damages resulting from such sources. Links or references to third-party websites are provided as a convenience and do not constitute an endorsement by CAWM, and the Firm is not responsible for the content of any such websites. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management fees or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio.